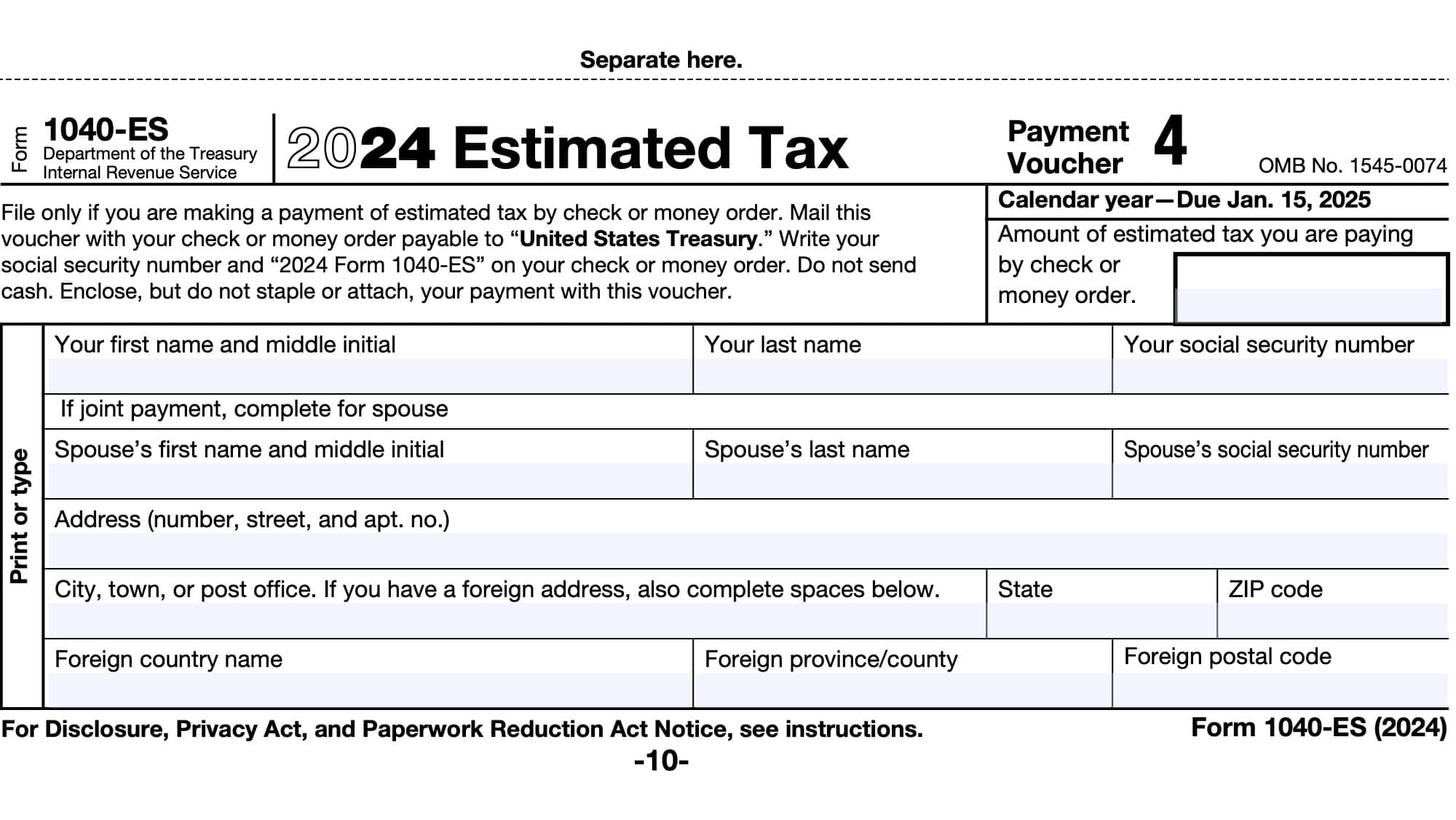

Irs Quarterly Tax Payment Form 2024. Forms 940 and 941 are both irs tax documents employers must file, but a 940 form is used to report unemployment taxes while form 941 is used to report medicare. In 2024, estimated tax payments are due april 15, june 17, and sept.

When are the quarterly estimated tax payment deadlines for 2024? The irs also reminded taxpayers affected by disasters in 17 states,.

Irs Quarterly Tax Payment Form 2024 Images References :

Source: ardysqmeredith.pages.dev

Source: ardysqmeredith.pages.dev

Irs Estimated Tax Payment Form 2024 Deana Estella, When are the quarterly estimated tax payment deadlines for 2024?

Source: filiayevangelina.pages.dev

Source: filiayevangelina.pages.dev

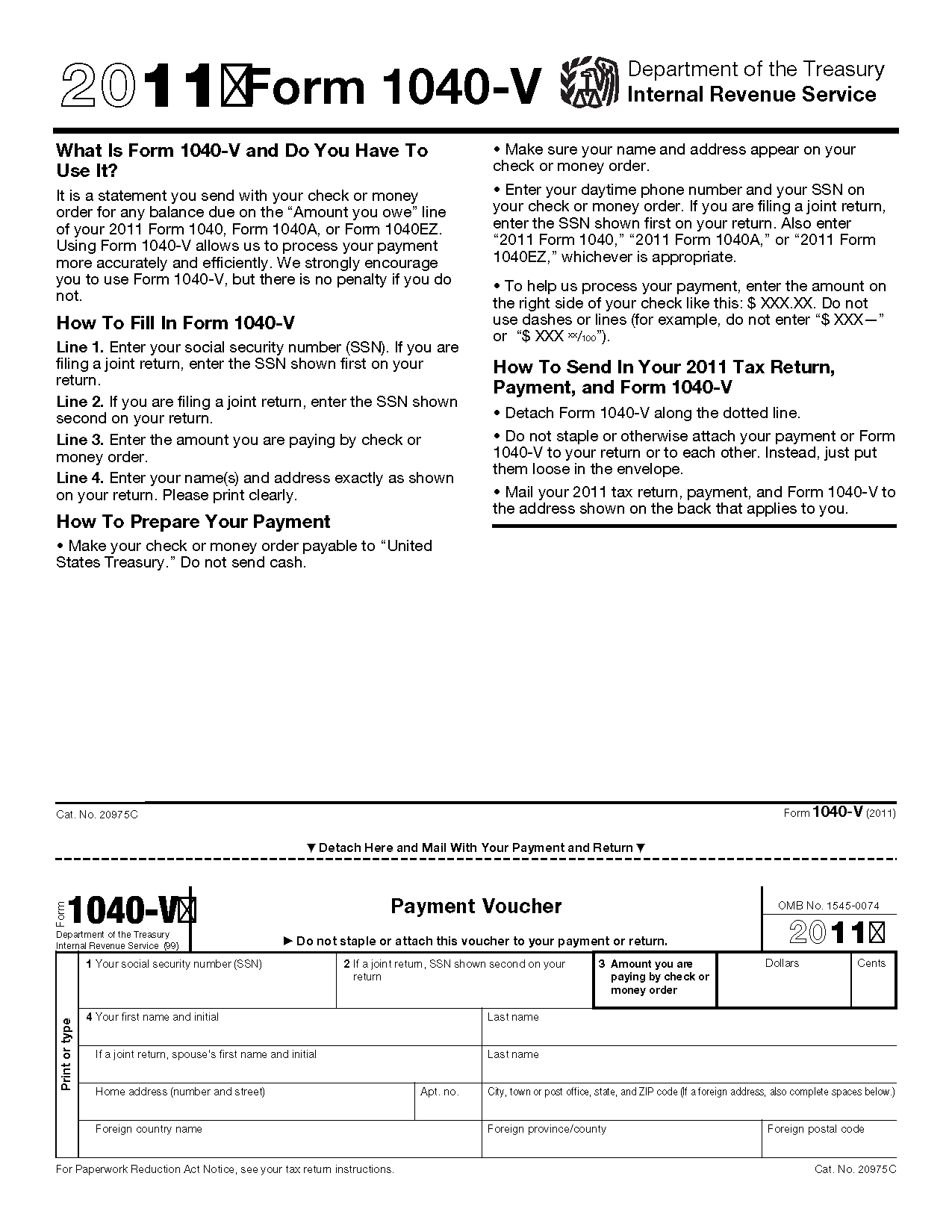

2024 Quarterly Tax Forms Pdf Free Download Effie Halette, You’ll need to confirm your identity before making a payment using pay now options.

Source: calqmaribelle.pages.dev

Source: calqmaribelle.pages.dev

Quarterly Tax Payment Forms 2024 Edie Nettie, This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception.

Source: odessawdasha.pages.dev

Source: odessawdasha.pages.dev

Irs Quarterly Payments 2024 Form 2024Es Daisy Therese, Try keeper's free quarterly tax calculator to easily calculate your estimated payment for both.

Source: stafaniwpru.pages.dev

Source: stafaniwpru.pages.dev

Quarterly Irs Payments 2024 Aleen Aurelea, You can pay your estimated taxes online through your irs account, the irs2go app, irs direct pay, or the electronic federal tax payment system (eftps).

Source: gelyaqtabatha.pages.dev

Source: gelyaqtabatha.pages.dev

Irs Quarterly Estimated Tax Payments 2024 Meara Marcela, The table below shows the payment deadlines for 2024.

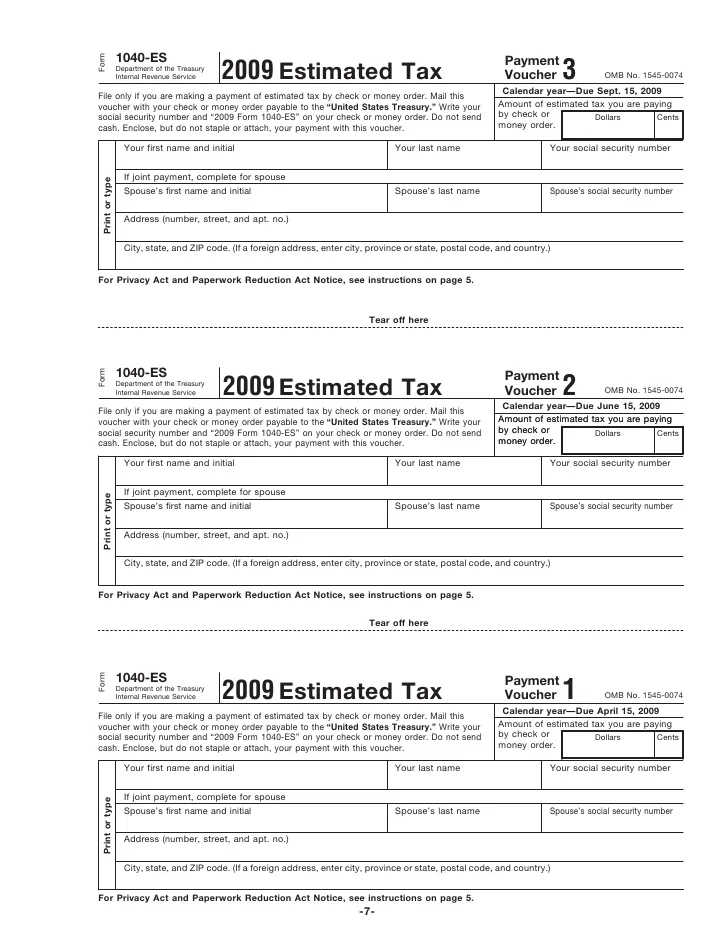

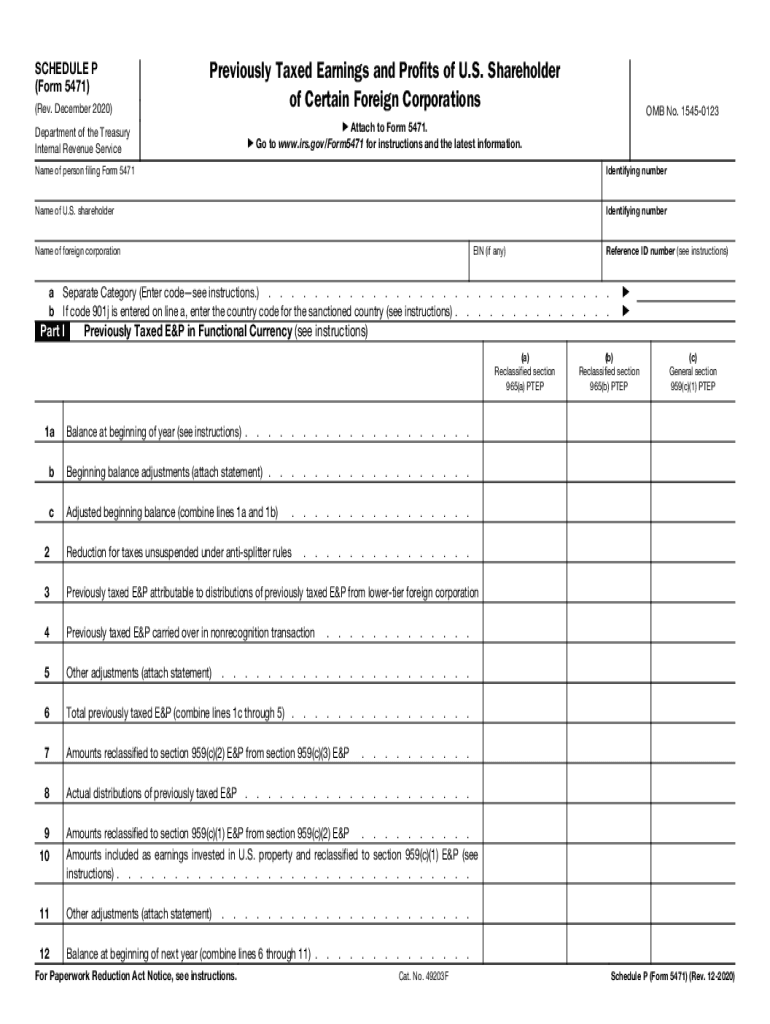

Source: www.pdffiller.com

Source: www.pdffiller.com

20202024 Form IRS 5471 Schedule P Fill Online, Printable, Fillable, The final quarterly payment is due january 2025.

Source: florayernesta.pages.dev

Source: florayernesta.pages.dev

Quarterly Tax Payments 2024 Irs Yetta Katerine, You’ll need to confirm your identity before making a payment using pay now options.

Source: florayernesta.pages.dev

Source: florayernesta.pages.dev

Estimated Tax Payments 2024 Forms Printable Yetta Katerine, 1099 workers have to pay estimated taxes if they owe over $1,000 in tax.

Source: fayrebshelly.pages.dev

Source: fayrebshelly.pages.dev

Irs 2024 Quarterly Estimated Tax Forms Hannie, In 2024, estimated tax payments are due april 15, june 17, and sept.

Category: 2024