87a Rebate For Ay 2025 26 New Tax Regime. This means a resident individual with taxable income up to rs. Under section 87a of the income tax act, 1961, a tax rebate is offered to resident individual taxpayers with taxable income up to ₹7 lakh.

However, a significant revision to the income tax slab structure has been. This means a resident individual with taxable income up to rs.

87a Rebate For Ay 2025 26 New Tax Regime Images References :

Source: eroppa.com

Source: eroppa.com

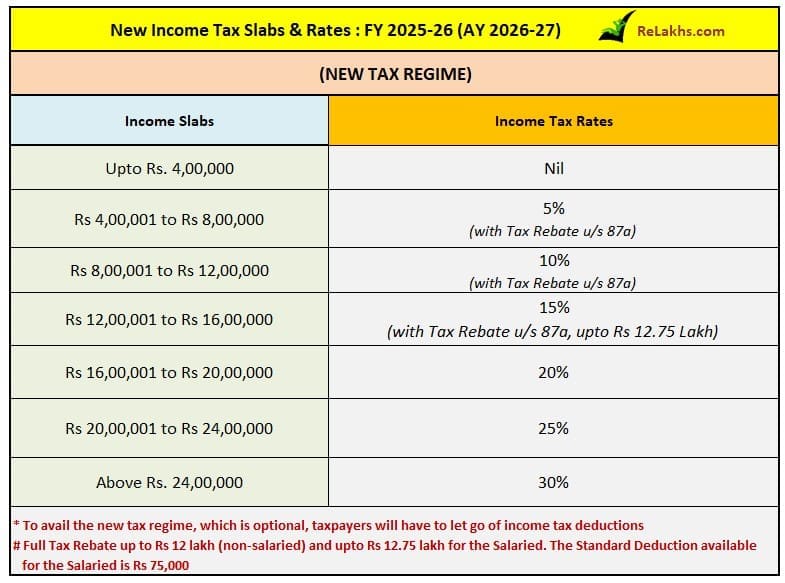

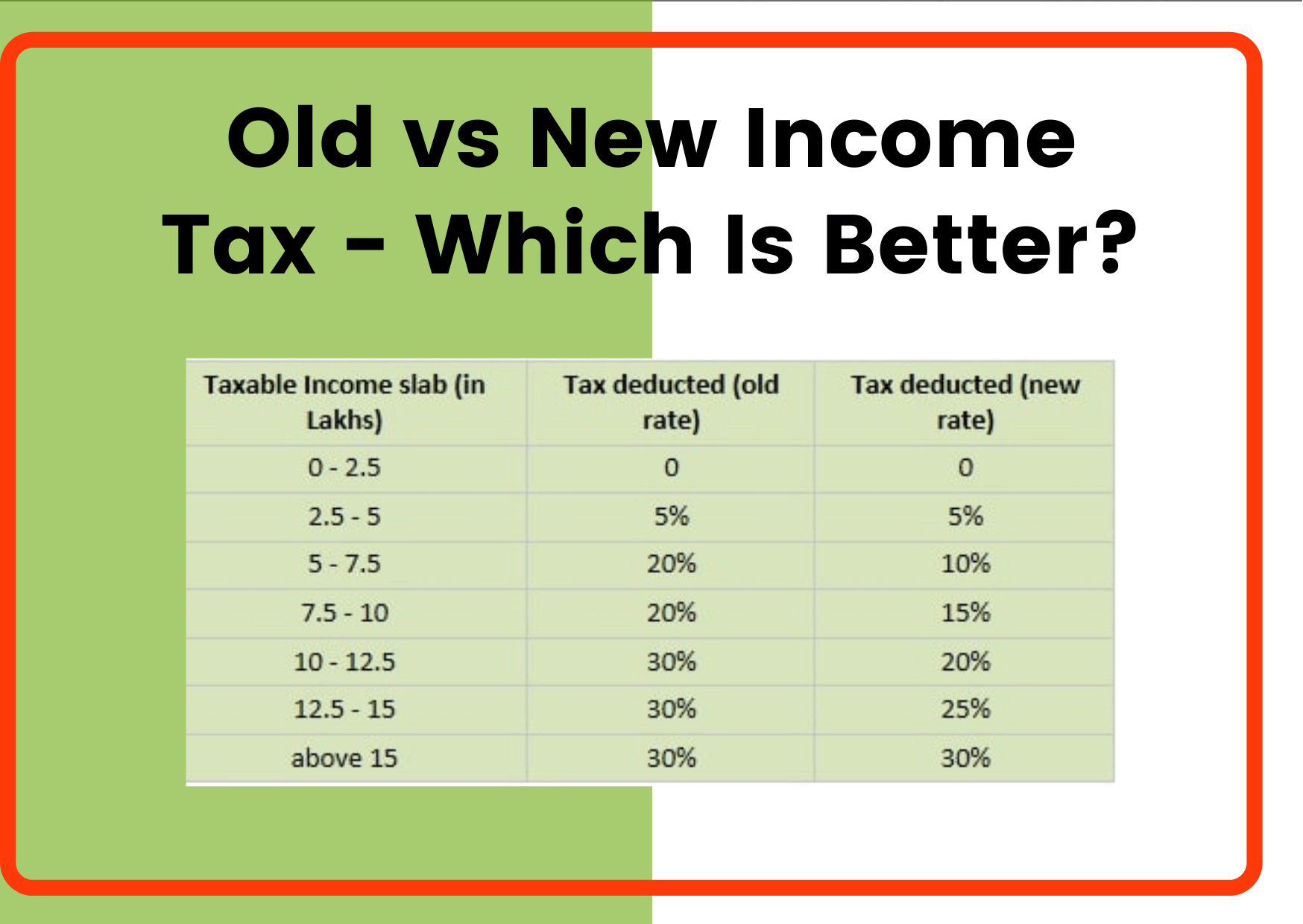

New Tax Regime 2025 Tax Slab 2025 26 New Tax Slab 2025 26, Budget 2025 provides marginal relief in specific instances.

Source: www.relakhs.com

Source: www.relakhs.com

Budget 2025 Key highlights & Important Tax Proposals, 12,500 under the old tax regime and rs.

Source: studycafe.in

Source: studycafe.in

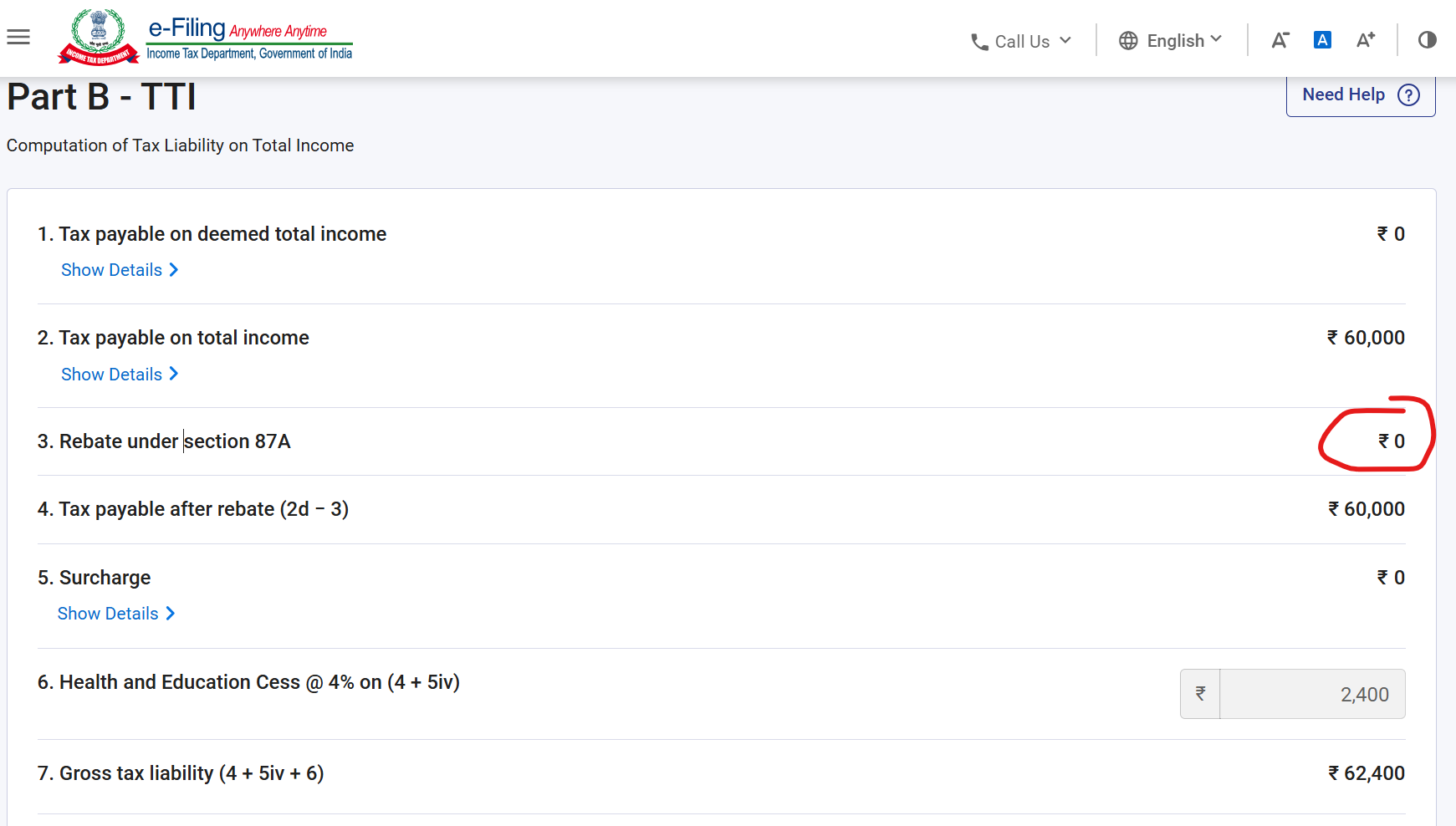

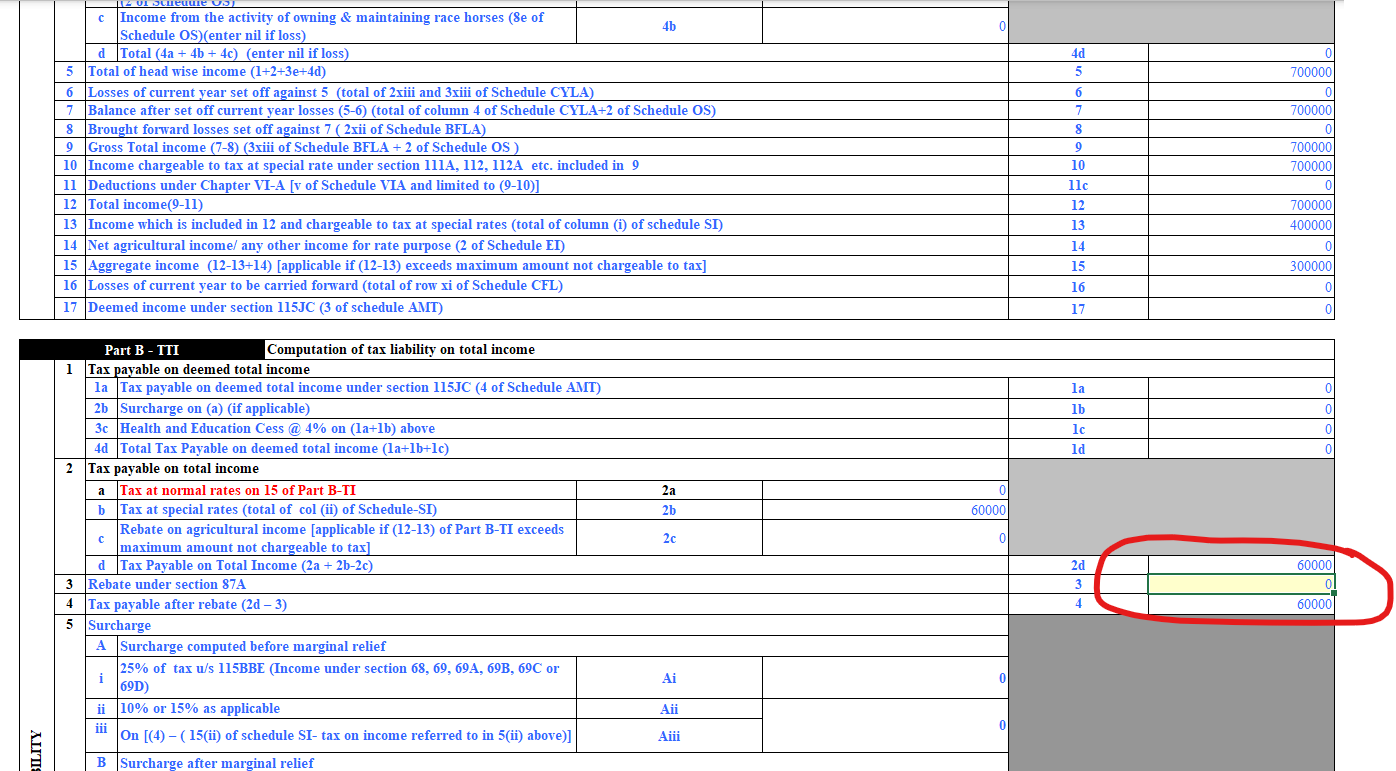

No Tax Rebate on Section 87A despite ITR Filing forms updated on the, The amendments, effective from april 1, 2026, aim to provide greater tax relief under the new tax.

Source: tradingqna.com

Source: tradingqna.com

Ask me anything about Union Budget 2025 Taxation Trading Q&A by, Under section 87a of the income tax act, 1961, a tax rebate is offered to resident individual taxpayers with taxable income up to ₹7 lakh.

Source: claralayla.pages.dev

Source: claralayla.pages.dev

New Regime Tax Calculator Ay 202525 Clara Layla, This allowance only applies to residents;

Source: studycafe.in

Source: studycafe.in

No Tax Rebate on Section 87A despite ITR Filing forms updated on the, Taxpayers can now benefit from revised tax slabs, along with an.

Source: adrianafaith.pages.dev

Source: adrianafaith.pages.dev

Tax Calculator 202525 New Regime Adriana Faith, › no tax for up to rs 12.75 lakh income for salaried under new tax regime as section 87a tax rebate hiked in.

Source: studycafe.in

Source: studycafe.in

No Tax Rebate on Section 87A despite ITR Filing forms updated on the, Under the new tax regime:

Source: palomagrace.pages.dev

Source: palomagrace.pages.dev

What Is Standard Tax Deduction For 2025 In India Paloma Grace, Under the new tax regime:

Source: kaseyhjkgaylene.pages.dev

Source: kaseyhjkgaylene.pages.dev

Tax Slab For A Year 202526 Opal Mignon, This means a resident individual with taxable income up to rs.

Category: 2025