Income Tax Slab For Ay 2025-24 Old Regime. 04 /14 old tax regime: Changes announced in the new tax regime in budget 2023.

The new tax slab would be the default tax slab. The new income tax regime will be the default tax regime.

, Et Online Last Updated:

Under the old tax system, they enjoy higher exemption limits.

Jun 16, 2023, 12:54:00 Pm Ist.

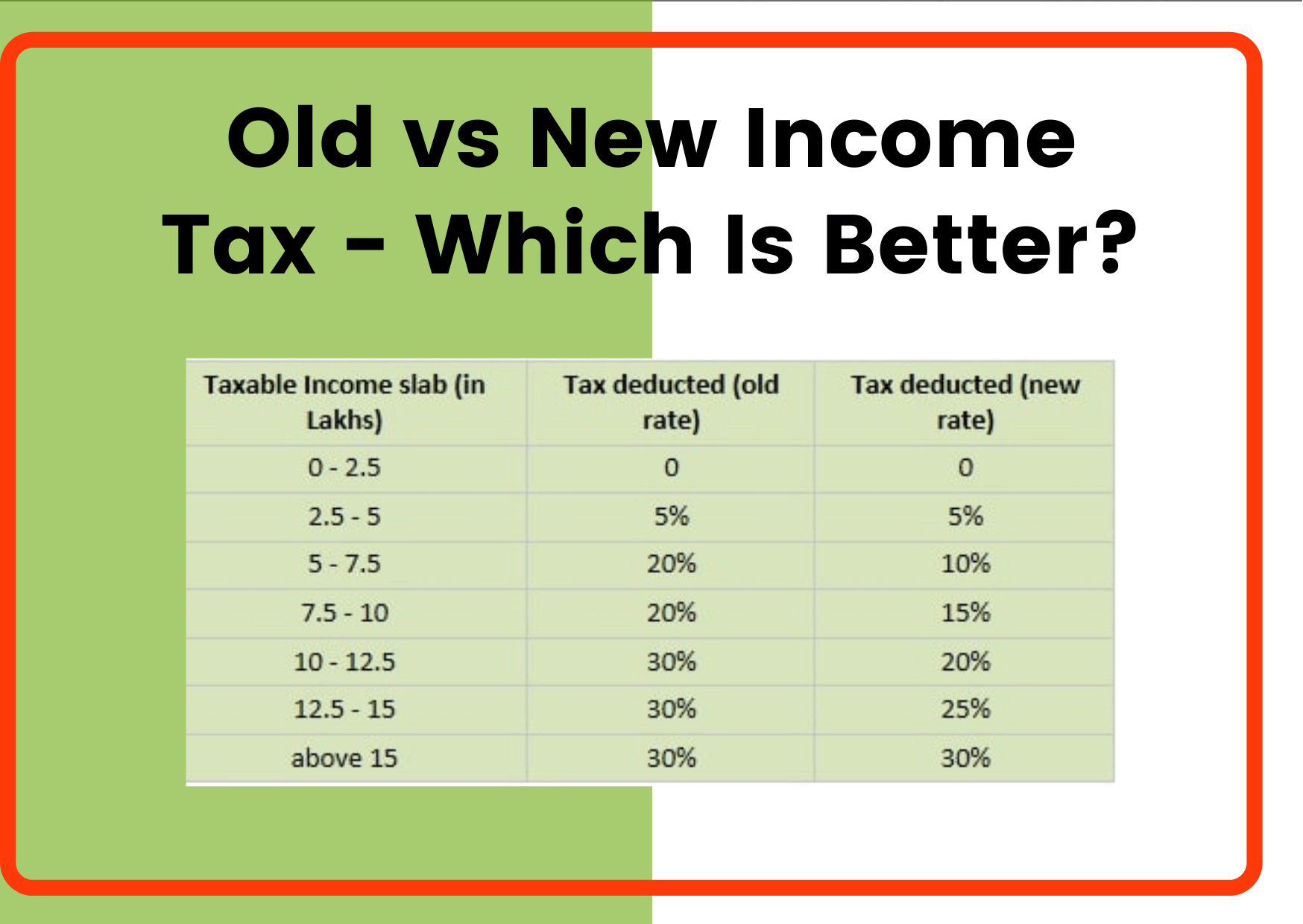

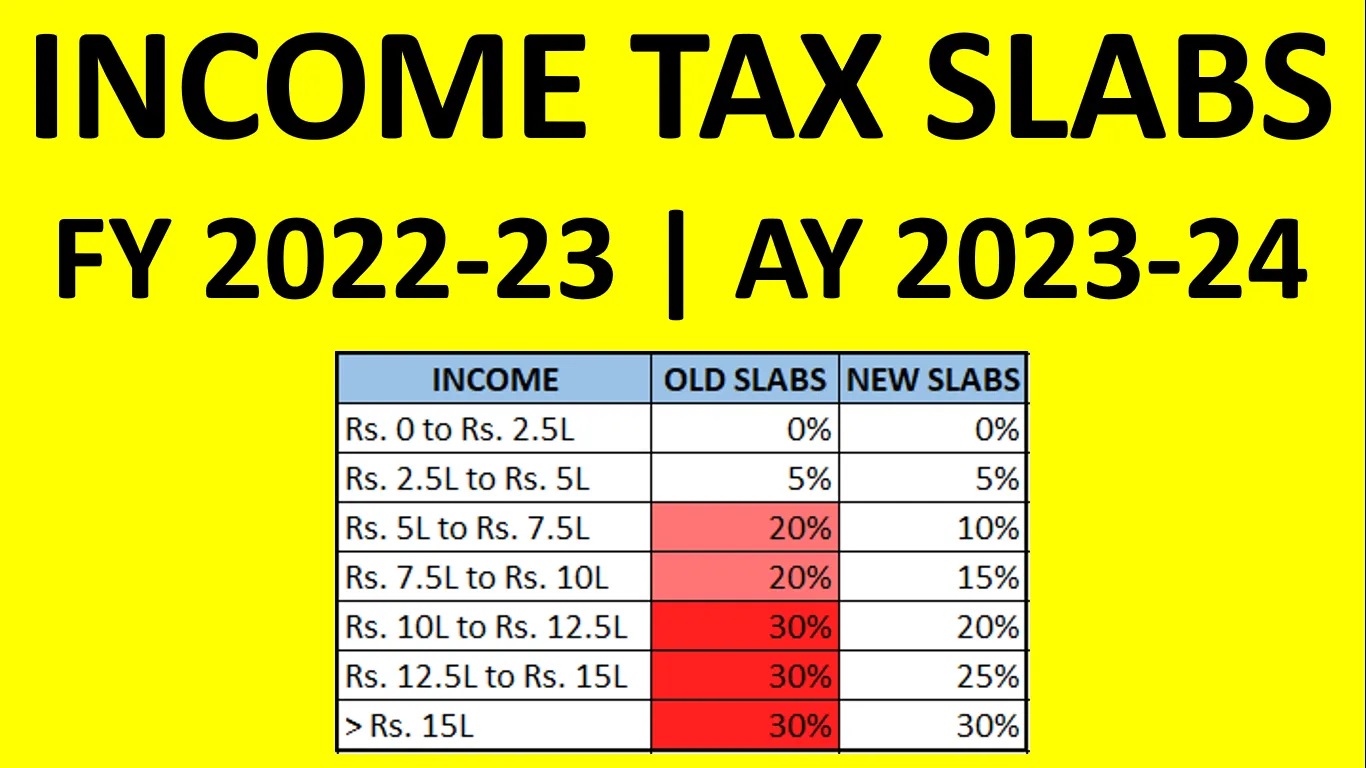

The introduction of the new tax regime in the 2020 budget, with further amendments in 2023, has stirred significant discussions among taxpayers.

New Income Tax Slab Rates Are Optional.

Images References :

Source: savemoremoney.in

Source: savemoremoney.in

Old Vs New Tax Slabs Who Should Choose What?, ₹15,000 + 10% on income exceeding ₹6,00,000. The rates of surcharge will be as under:

Source: www.vrogue.co

Source: www.vrogue.co

New Tax Regime Vs Old Which Is Better For You? Rupiko Peoplesoft, Refer examples & tax slabs for easy calculation. 5% on income exceeding ₹3,00,000.

Source: career-pavitraindia.blogspot.com

Source: career-pavitraindia.blogspot.com

Tax Rebate में 10 का छूट और 7 Slab रहेगा लागू. मात्र 2.5 लाख, What changes have been made in the new tax regime? Section 194p is applicable from 1st april 2021.

Source: cleartax.in

Source: cleartax.in

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Make new tax regime the default tax regime for the assessee being an individual, huf, aop. The new tax slab would be the default tax slab.

Source: www.techicy.com

Source: www.techicy.com

Understanding Form 16 and Its Relevance In Tax Slab Techicy, 04 /14 old tax regime: Changes announced in the new tax regime in budget 2023.

Source: imagetou.com

Source: imagetou.com

Tax Slabs Fy 2023 24 Image to u, The finance minister made changes in the income tax slabs under the new tax regime. The introduction of the new tax regime in the 2020 budget, with further amendments in 2023, has stirred significant discussions among taxpayers.

Source: sarkarinewsportal.in

Source: sarkarinewsportal.in

Tax Slab 202324 Budget Check Here सरकारी न्यूज़ पोर्टल, Basic exemption limit for senior citizens. In the advanced calculator tab, enter the following details:

Source: neswblogs.com

Source: neswblogs.com

Tax Rate For Married Filing Jointly 2022 Latest News Update, Under the old tax system, they enjoy higher exemption limits. Discover the tax rates for both the new tax regime and the old tax regime according to the budget 2025.

Source: www.stkittsvilla.com

Source: www.stkittsvilla.com

New Tax Regime Complete List Of Exemptions And Deductions Disallowed, Discover the tax rates for both the new tax regime and the old tax regime according to the budget 2025. If the net annual income is under 5 lakh, rebate under section 87a is allowed and is limited to rs.

Source: timiqeveleen.pages.dev

Source: timiqeveleen.pages.dev

Tax Rates For Ay 202425 New Regime Sonia Eleonora, 04 /14 old tax regime: New regime income tax slab rates for individual.

Recently, In Budget 2023, The Government Has Reduced The Slab Rates For Taxpayers And Extended The Standard Deduction Benefit To Salaried Individuals And Pensioners In The New Tax Regime.

Basic exemption limit for senior citizens.

The New Tax Slab Would Be The Default Tax Slab.

Preferred tax regime, ay, taxpayer category, age, residential status, due date and actual date of submission of return.