Nys Estimated Tax Payments 2024 Voucher. How do you make estimated tax payments? Paying estimated tax helps your clients avoid owing money at the end of the year when they file their tax returns and avoid accruing interest and penalty.

To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for. You expect to owe less than $300 of new york state, $300 of new york city, and $300 of yonkers income tax after deducting.

Choose From The Following Faqs About New York And New York City Payment.

To avoid a penalty, your estimated tax payments plus your withholding and refundable credits must equal either of these:

Paying Estimated Tax Helps Your Clients Avoid Owing Money At The End Of The Year When They File Their Tax Returns And Avoid Accruing Interest And Penalty.

You do not need to pay estimated tax if:

If Your Clients Need To Cancel A Scheduled Estimated Tax Payment, You Or Your Clients May Do So Through Online Services—Even If The Payment Was Scheduled Using Software.

Images References :

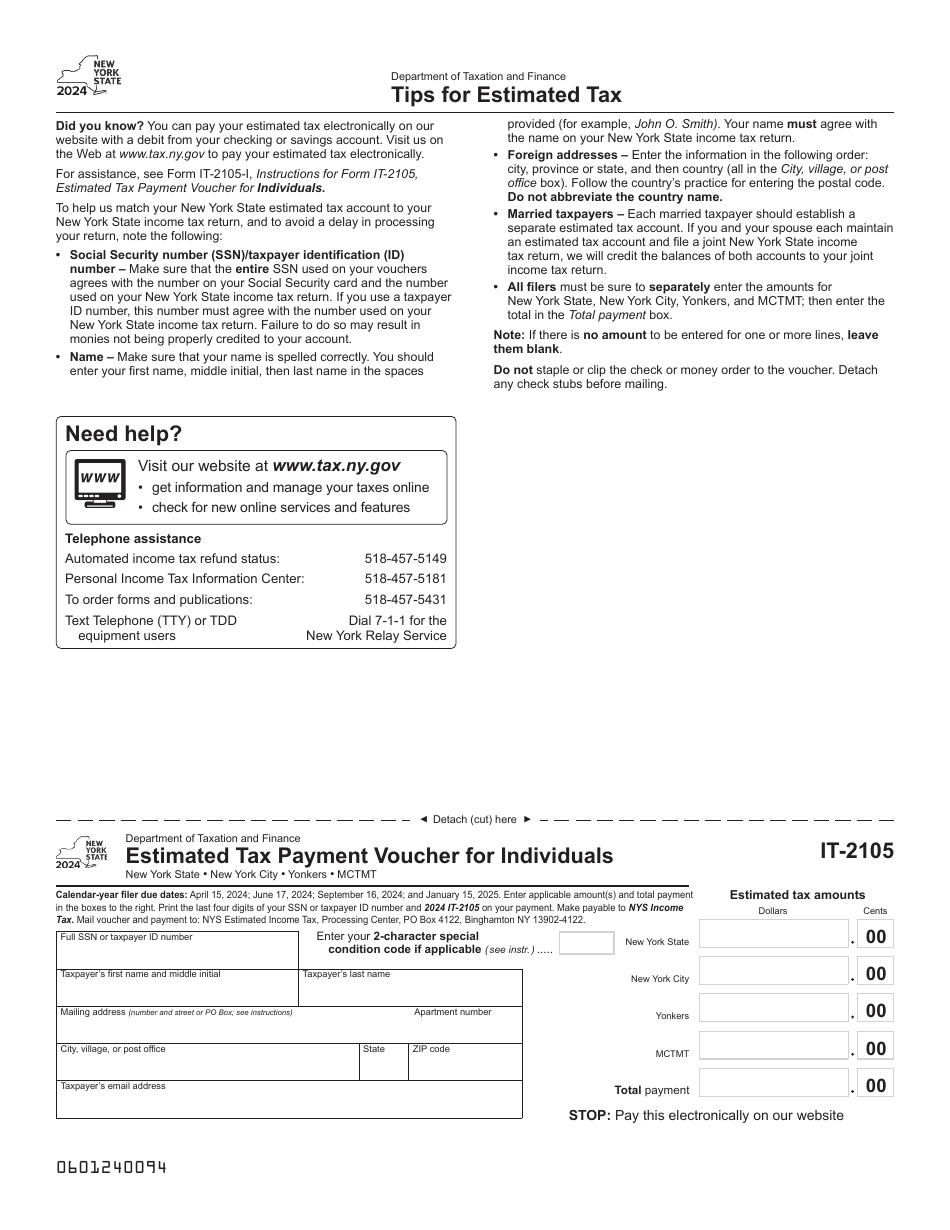

Source: www.templateroller.com

Source: www.templateroller.com

Form IT2105 Download Fillable PDF or Fill Online Estimated Tax Payment, 31, 2024, and pay the entire balance due at that time, you won't have to make the final. Go to the input return tab.

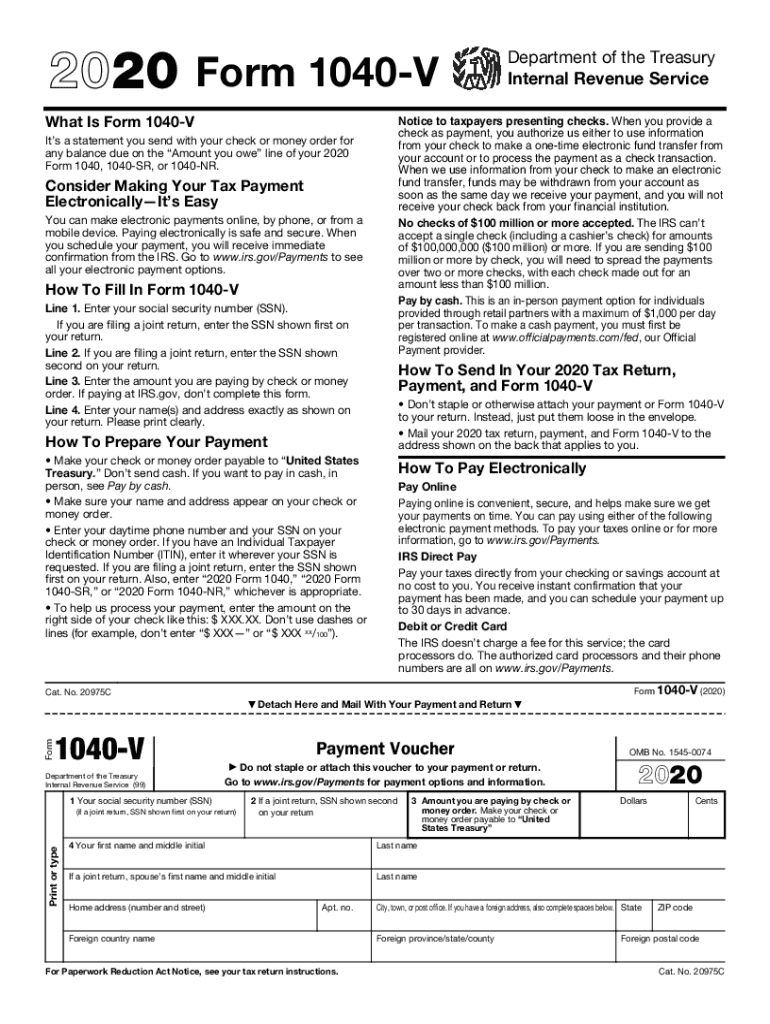

Source: www.signnow.com

Source: www.signnow.com

Payment 20202024 Form Fill Out and Sign Printable PDF Template, Solved • by intuit • 3 • updated almost 2 years ago. 31, 2024, and pay the entire balance due at that time, you won't have to make the final.

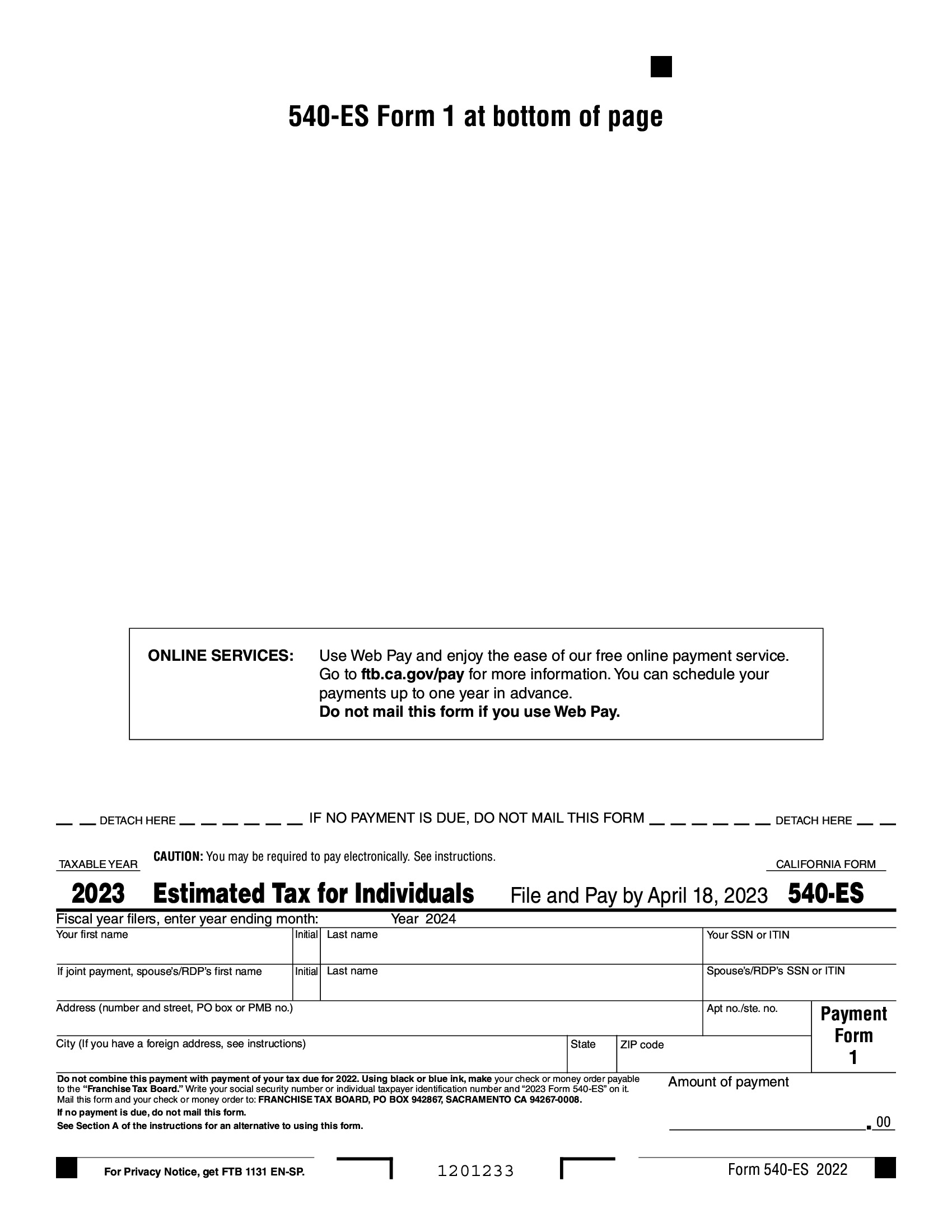

Source: blanker.org

Source: blanker.org

FTB Form 540ES. Estimated Tax for Individuals Forms Docs 2023, To avoid a penalty, your estimated tax payments plus your withholding and refundable credits must equal either of these: Choose from the following faqs about new york and new york city payment.

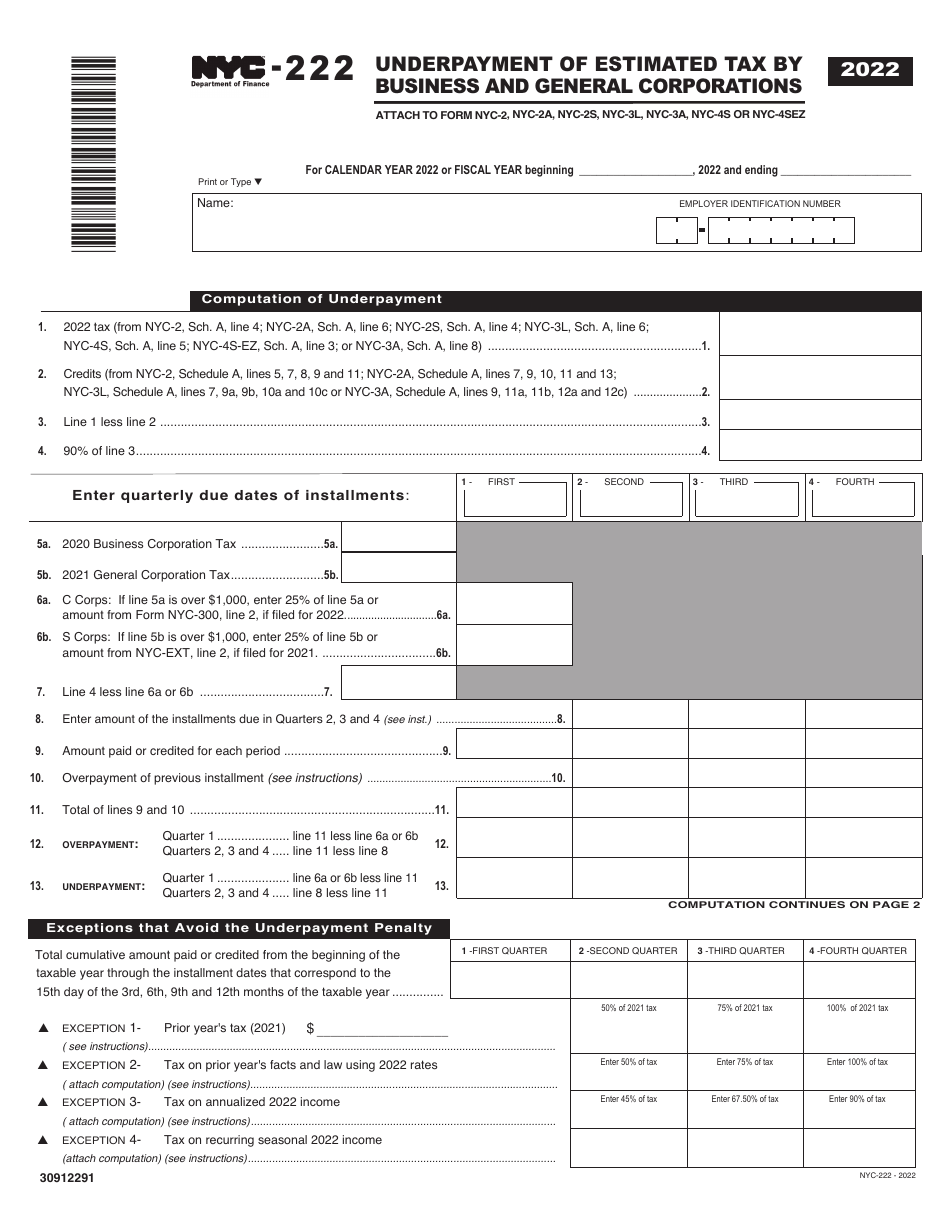

Source: www.templateroller.com

Source: www.templateroller.com

Form NYC222 Download Printable PDF or Fill Online Underpayment of, Quarterly estimated ptet payments for tax year 2023 are due march 15, june 15, september 15, and december 15, 2023. These options are to pay:

Source: berriqanabelle.pages.dev

Source: berriqanabelle.pages.dev

Estimated Tax Dates 2024 Cindi Delores, Four of these options are based on a percentage of tax from both the prior year and the current year. These options are to pay:

Source: www.signnow.com

Source: www.signnow.com

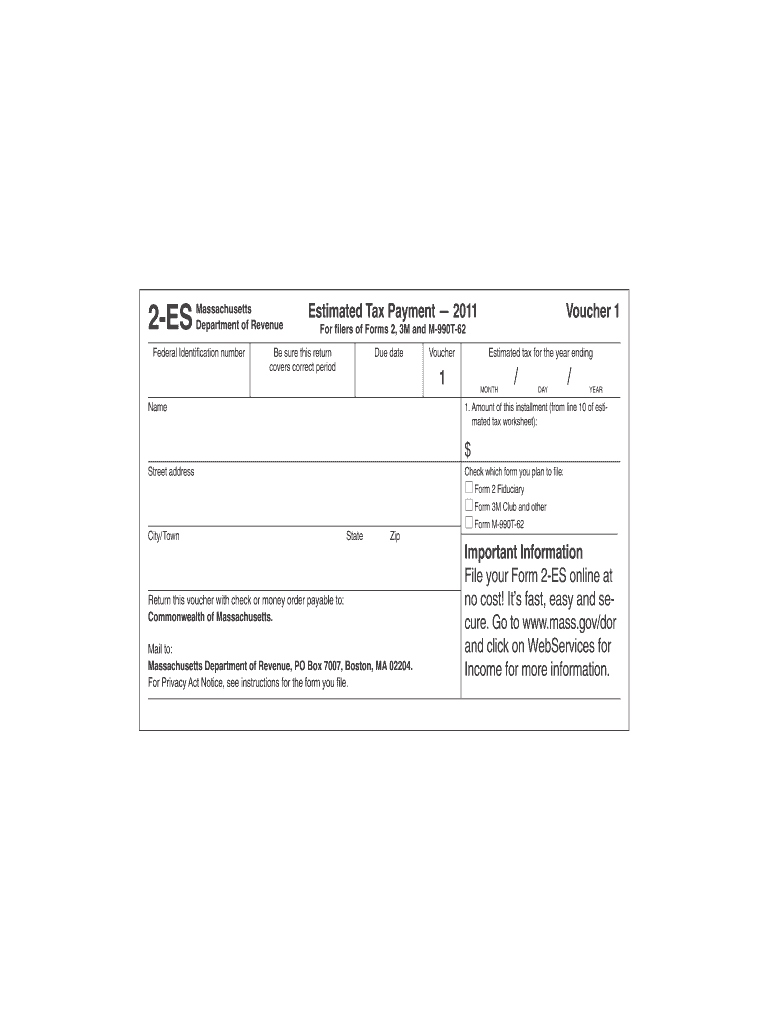

Estimated Tax Payment Voucher 1 1 Important Information Mass Fill, You expect to owe less than $300 of new york state, $300 of new york city, and $300 of yonkers income tax after deducting. You can quickly estimate your new york state tax and federal tax by selecting the tax year, your filing.

Source: www.signnow.com

Source: www.signnow.com

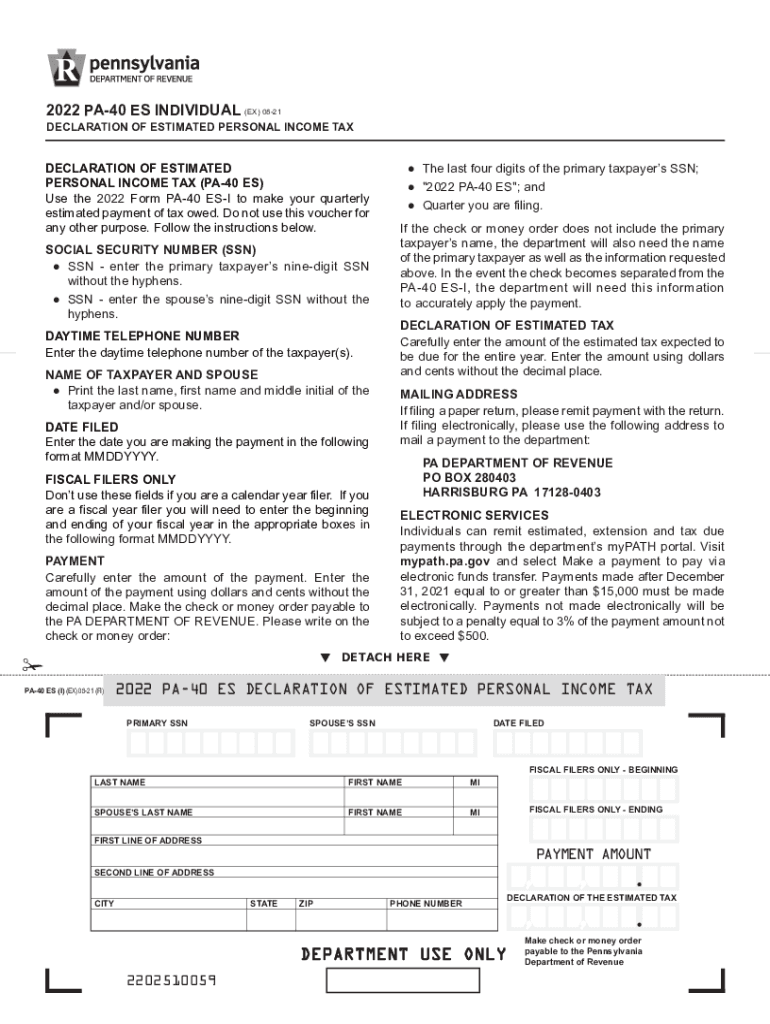

Pa 40 Es 20222024 Form Fill Out and Sign Printable PDF Template, Additionally, if you submit your 2023 federal income tax return by jan. You can meet this requirement.

Source: www.dochub.com

Source: www.dochub.com

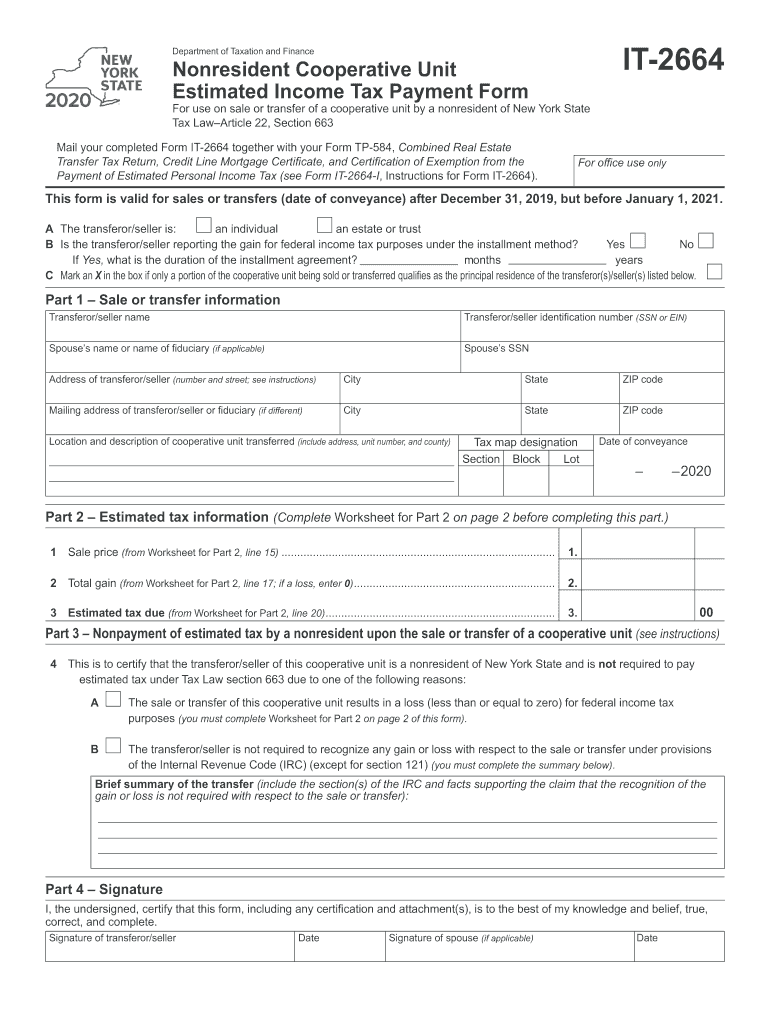

2020 form ny Fill out & sign online DocHub, 100% of the tax based on your 2023 income. You expect to owe less than $300 of new york state, $300 of new york city, and $300 of yonkers income tax after deducting.

Source: www.signnow.com

Source: www.signnow.com

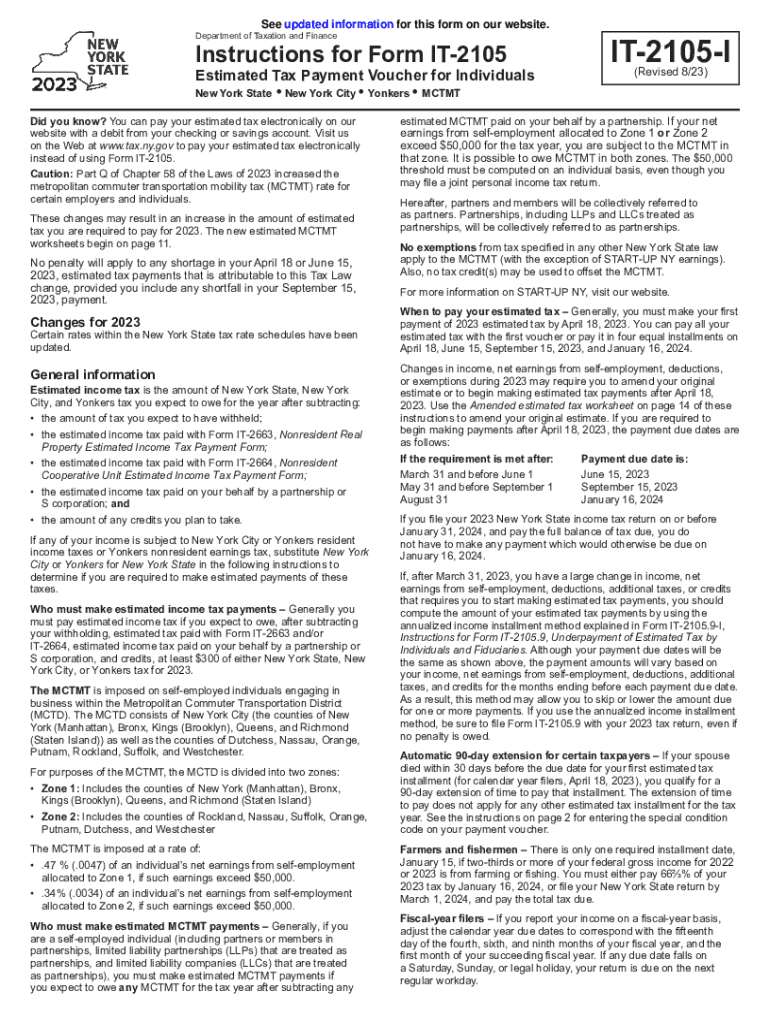

Instructions for Form it 2105 Estimated Tax Payment Voucher for, How to make an estimated payment. Paying estimated tax helps your clients avoid owing money at the end of the year when they file their tax returns and avoid accruing interest and penalty.

Source: kennaqjoleen.pages.dev

Source: kennaqjoleen.pages.dev

2024 Form 2024Es Payment Voucher Printable Nj Eda Kathye, Paying estimated tax helps your clients avoid owing money at the end of the year when they file their tax returns and avoid accruing interest and penalty. To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for.

Request A Payment Plan You Can Request A Payment Plan For Making Tax Payments Through Tap.

Go to the input return tab.

Additionally, If You Submit Your 2023 Federal Income Tax Return By Jan.

Solved • by intuit • 3 • updated almost 2 years ago.